Corporate Governance

Basic concept for Alfresa Group's corporate governance

As a company conducting business in a field related to life and health, the Group has determined to put the Group's Principles into practice and to fulfill our responsibilities to our various stakeholders. The Group believes that the enhancement of corporate governance is fundamental to fulfilling corporate social responsibilities and to enhancing corporate value. Going forward, the Company will continue to promote initiatives in line with the purpose of the Corporate Governance Code, working to further increase corporate value.

From the perspective of achieving sustainable growth and long-term enhancement of corporate value, the Group regards the essence of corporate governance as being the assurance of the transparency and fairness of decision-making, the full and effective use of management resources, and the improvement of management vitality by means of rapid and resolute decision-making. Accordingly, the Group will work to enhance corporate governance in line with the following basic concepts.

- To respect shareholders' rights and ensure equality of treatment.

- To build good and harmonious relationships with stakeholders including shareholders.

- To disclose corporate information appropriately and ensure transparency.

- To build a structure that effectively utilizes outside directors and outside Audit & Supervisory Board members, ensuring the effectiveness of the Board of Directors' supervisory function of business execution.

- To enhance internal control systems, including the assurance of the reliability of financial reporting.

- To engage in constructive dialogue with shareholders who share the same medium- to long-term interests.

- To endeavor to maintain information security by protecting the information the Group holds from various security threats and handling it appropriately

Establishment of Corporate Governance Guidelines

The Alfresa Group has established Corporate Governance Guidelines as basic principles concerning corporate governance. The purpose of these guidelines is to further enhance corporate value so that the Group can fulfill its responsibilities to customers, business partners, employees, shareholders, local communities, and other stakeholders in a manner characterized by reliability, safety and sincerity by realizing its principles in the form of Our Philosophy, Our Vision, and Our Promises.

Corporate Governance Guidelines(302KB)

Corporate Governance Structure

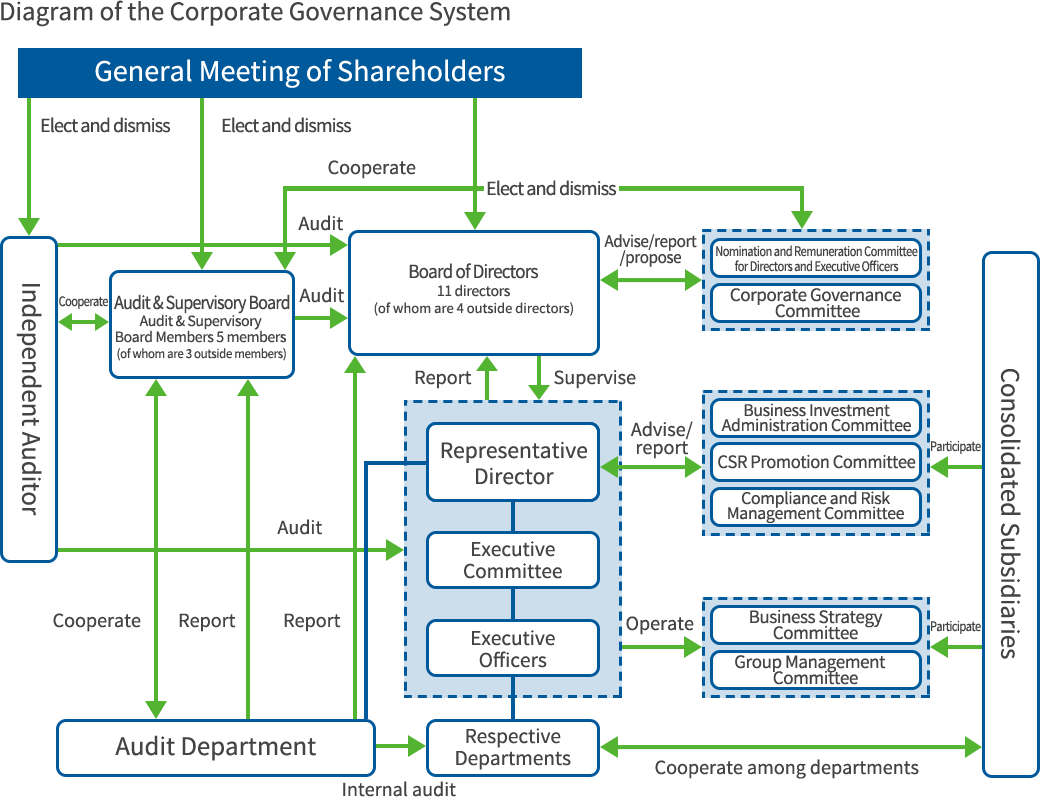

For its organizational structure as provided for in the Companies Act, the Company shall select the structure of a company with an Audit & Supervisory Committee. The Audit & Supervisory Committee shall audit directors' performance of their duties.To clarify the division of responsibilities for managerial decision-making, supervision, and business execution, the Company shall adopt an executive officer system. The responsibilities for decision-making and supervision are assumed by the Board of Directors, and responsibility for business execution is assumed by the executive officers.

Corporate Governance Report(870KB)

as of June 25,2025

Overview of the Board of Directors, Audit and Supervisory Committee and Advisory Committee

| Name | Description |

|---|---|

| Board of Directors | Chaired by the president, the Company's Board of Directors is made up of twelve directors (nine men and three women, of whom six are outside directors). Regular meetings are held once per month, in principle, but extraordinary meetings may also be convened as necessary. These meetings are held to approve important matters stipulated by laws and regulations, as well as determine matters pertaining to management, and to supervise directors' performance of their duties. |

| Audit and Supervisory Committee | The Company’s Audit and Supervisory Committee, composed of four individuals (three men and one woman), has one full-time Audit and Supervisory Committee Member and three outside Audit and Supervisory Committee Members (one attorney, one certified public accountant, and one who holds credentials as a certified public accountant and possesses managerial experience). The Audit and Supervisory Committee, in principle, meets once a month to report audit results and discuss audit details. From the viewpoint of fully fulfilling its roles and responsibilities, the Audit and Supervisory Committee organically combines the advanced information-gathering skills of the full-time Audit and Supervisory Committee Member with the strong independence and high level of expertise of the outside Audit and Supervisory Committee Members to improve its audit quality and effectiveness. |

| Nomination and Remuneration Committee for Directors and Executive Officers | The Nomination and Remuneration Committee for Directors and Executive Officers is made up of five directors (including three outside directors, of whom one is the chairperson) who are elected on the basis of resolutions of the Board of Directors. The Committee deliberates on election and dismissal with respect to directors and executive officers of the Company and a specified wholly owned subsidiary Alfresa Corporation, remuneration with respect to directors and executive officers of the Company, as well as other important matters related to management. |

| Business Investment Administration Committee | The Business Investment Administration Committee creates opportunities to deliberate on business investment projects submitted by the Company or Group companies that exceed the standard amount and important investment projects that require multifaceted and careful consideration. The Committee also establishes a system to report these results to the Executive Committee or the Board of Directors. |

| Group Sustainability Promotion Committee | The Group Sustainability Promotion Committee works with Group companies to consider important policies related to Sustainability for the entire Group in order to contribute to increasing corporate value over the medium- to long-term, creates opportunities to report and evaluate the Sustainability activities of the Company and each Group company, and also establishes a system to report these results to the representative director and the Board of Directors. |

| Group Compliance and Risk Management Committee | The Compliance and Risk Management Committee formulates compliance and risk management promotion plans, considers important policies regarding compliance and risk management for the entire Group, creates opportunities to report and evaluate the compliance and risk management activities of the Company and each Group company, and also establishes a system to report to the representative director and the Board of Directors. Subcommittees are established and limited to particular business segments, business categories, or type of operations in order to ensure more appropriate and systematic responses to inherent risks in specific, highly specialized businesses, in addition to plenary meetings. |

Overview of Each Meeting Body

| Name | Description |

|---|---|

| Executive Committee | The Executive Committee is made up of the representative director, directors, and executive officers nominated by the Company's Board of Directors. The Committee deliberates and approves matters related to the management of the Company, apart from the matters the Company's General Meeting of Shareholders and Board of Directors are responsible for approving. Regular meetings are held twice per month, in principle, but extraordinary meetings may also be convened as necessary. |

| Business Strategy Committee | The Business Strategy Committee comprises executive directors and executive officers of the Company, and also appointed officers and employees from the Company and certain Group companies. Regular meetings are held every month, in principle, but extraordinary meetings may also be convened as necessary. |

| Group Management Committee | The Group Management Committee comprises the directors, and executive officers, and Group company presidents appointed in advance by the chairperson of the Committee. Regular meetings are held three times a year, in principle, but extraordinary meetings may also be convened as necessary. The Committee's role is to align the management intentions of Group companies. As such, the Committee discusses the common business issues related to overall Group management. |

Skill Matrix for Members of the Board of Directors

Composition of the Board of Directors

The Board of Directors consists of diverse directors with different specialized knowledge, experience, and abilities in order to effectively fulfill their roles and responsibilities. Its current size has been determined as the best for facilitating efficient and effective execution of its functions

Nomination and Appointment of Board of Directors

Candidates for Directors are decided by the Board of Directors after deliberation by the Nomination and Remuneration Committee for Directors and Executive Officers, taking into consideration the composition of the Board of Directors.The Nomination and Remuneration Committee for Directors and Executive Officers consists of independent Outside Directors and Directors selected by resolution of the Board of Directors. The majority of its members are independent Outside Directors.

It also selects candidates by defining the skills of Directors that it deems necessary for realizing the AlfresaGroup's MediumtoLong-Term Vision. A list of these skills is shown in the table below.

(As of June 25, 2025)

| Position | Corporate management | Sales and marketing | Logistics and SCM | Business development and DX | Finance and accounting | Legal and risk management | Human resources and talent development | ||

|---|---|---|---|---|---|---|---|---|---|

| Directors | Ryuji Arakawa |

Representative Director & President | ● | ● | ● | ||||

| Yusuke Fukujin |

Representative Director & Executive Vice President | ● | ● | ● | |||||

| Shigeki Ohashi |

Director, Vice President & Executive Officer |

● | ● | ● | |||||

| Toshiki Tanaka | Director, Vice President & Executive Officer |

● | ● | ● | ● | ● | |||

| Koichi Shimada |

Director | ● | ● | ||||||

| Manabu Kinoshita |

Outside Director | ● | ● | ● | |||||

| Toshie Takeuchi |

Outside Director | ● | ● | ||||||

| Kimiko Kunimasa |

Outside Director | ● | ● | ||||||

| Audit & Supervisory Board Members | Yuji Ueda |

Director (Audit and Supervisory Committee Member) |

● | ● | |||||

| Takashi Ito |

Outside Director (Audit and Supervisory Committee Member) |

● | |||||||

| Hiroshi Kizaki |

Outside Director (Audit and Supervisory Committee Member) |

● | ● | ● | ● | ||||

| Sachiko Iizuka | Outside Director (Audit and Supervisory Committee Member) |

● | ● | ● | |||||

※SCM = Supply Chain Management

Outside Directors

Our basic policy is to appoint multiple independent outside directors. Currently, six outside directors who meet our independence standards have been appointed, and are designated as independent directors.

Outside directors are elected from persons with pragmatic points of view, based on extensive corporate management experience, or are objective and professional, based on high-level insight into such areas as social and economic trends.

Independence Standards for Outside Directors

The Company elects candidates for Outside Director. who have high degree of independence.

- Outside Director must be financially independent from the Group.

- Outside Director should not have received compensation (excluding remuneration to Director paid by the Company), or monetary consideration/other properties for performed duties, transactions that exceed a certain amount directly from the Group in the past five years.

- "Exceed a certain amount" is defined to be the amount of ¥10 million or more received in any one of the past five fiscal years.

- Outside Director should not have served as Director, Officer of any one of the following entities in the past five years.

- Major business clients who account for 2% or more of the consolidated net sales of the Group or the corporate groups, to which the candidate belongs.

- Entities that have substantial conflicts of interest with the Group, such as the Company's independent auditing firm

- Entities that are the Company's major shareholders (holding 10% or more of shares issued).

- Entities of which the Group is the major shareholder (holding 10% or more of shares issued).

- Outside Director should not have received compensation (excluding remuneration to Director paid by the Company), or monetary consideration/other properties for performed duties, transactions that exceed a certain amount directly from the Group in the past five years.

- Outside Director shall not be the close relatives of Director and Audit & Supervisory Board Members of the Group.

- "Close relatives" are defines as spouse, blood relatives within third degree of kinship, and relatives living together.

- Furthermore, Outside Director shall not possess any reason by which they are reasonably deemed ineligible as an independent and neutral officer.

- Outside Director shall ensure to satisfy the independence and neutrality criteria set forth in this Standards on an ongoing basis even after the appointment as Officer.

Officer remuneration

Our directors' remuneration, etc. is based on the standard amount for each rank of director. In setting this standard amount, we use remuneration data from external specialist organizations as well as publicly-available information to assess the remuneration level of companies in both the same and other industries.

The remuneration composition differs between executive directors, non-executive directors (including outside directors), and directors who are Audit & Supervisory Committee members. In addition to basic (fixed) remuneration, executive directors are compensated with performance bonuses linked primarily to the achievement of performance targets for each fiscal year, and performance-linked stock compensation. The purpose of the latter is to motivate directors and other officers aimed at achieving the medium- to long-term performance objectives set out in the Company's "25-27 Mid-term Management Plan" and enhancement of medium- to long-term corporate value. We have introduced a system of performance-linked stock compensation using a BIP trust for officer compensation. Meanwhile, in case it would become unable to provide stock compensation under such system, we have instituted a system of stock price-based compensation as an alternative; it pays a monetary amount instead of stock calculated based on the same method as the performance-linked stock compensation system.

- Method of Calculating Performance-Linked Remuneration

- Method of calculating bonuses

The amount of bonuses paid was determined individually by multiplying the base amount by the bonus composition ratio (20%) within a range from 0% to 150%, in accordance with the degree of achievement against initial planned figures for consolidated operating profit value for each fiscal year and net income value attributable to owners of the parent for each fiscal year in order to ensure our values are aligned with those of shareholders and to further motivate officers to contribute to corporate performance. - Method of calculating stock compensation (stock price-linked compensation) Method of calculating stock compensation

Stock compensation serves as an incentive to increase corporate value over the long term. The number of our shares to be issued is determined by annually granting and accumulating the base points calculated according to the amount obtained by multiplying the base amount by the stock compensation composition ratio (12%), and after the conclusion of the medium-term management plan, varying the cumulative value of the base points within the range of 0% to 150% according to the achievement level of the business performance targets in the medium-term management plan. As with bonuses, the performance indicators utilized include the consolidated operating profit, consolidated ROE (Return On Equity), TSR (Total Shareholder Return), ESG external evaluation, employee engagement, etc., which have been positioned as key performance indicators in the medium-term management plan. In doing so, we aim to ensure our values are aligned with those of shareholders and to further motivate officers to contribute to corporate performance.

- Method of calculating bonuses

- Method of Deciding on Remuneration, etc.

-

At the Company, the Nomination and Remuneration Committee for Directors and Executive Officers, which is a voluntary committee with a majority membership of independent outside directors chaired by an independent outside director, deliberates policies for determining remuneration for directors other than those who are Audit & Supervisory Committee members (including the remuneration composition and base amounts), calculation methods for the remuneration, total remuneration, and other related matters. Based on these deliberations, the matters are referred to the Board of Directors where decisions are taken.

The amount of remuneration, etc. for individual directors (excluding those who are Audit & Supervisory Committee Members) are determined based on deliberations by the Nomination and Remuneration Committee for Directors and Executive Officers on performance evaluations. In addition, the amount of remuneration, etc. for individual directors who are Audit & Supervisory Committee members is determined in consultation with the Audit & Supervisory Committee.

-

Investment Securities

-

Classification Criteria and Approach

With regard to the classification of investment securities held for purely investment purposes and investment securities held for purposes other than pure investment, those that are held entirely for the purpose of receiving profit from changes in the price of the shares or dividends pertaining to the shares are classed as investment securities held for purely investment purposes.

-

Policy and Method of Examining the Rationality of Holdings

The Alfresa Group's policy on holding investment securities is to hold only shares that align with an important strategic purpose, such as maintaining and developing good business and collaboration relationships, or creating new business opportunities related to realizing a Healthcare Consortium, and to reduce holdings of shares that do not have such important purposes. Based on this policy, each year, we judge whether the original purpose of our holding remains valid for every investee company, quantitatively verify that the benefits and risks associated with our holdings are commensurate with capital costs, and qualitatively verify the purpose of our holdings over the mid- to long term. These results are reported to the Board of Directors.